Volunteer Income Tax Assistance (VITA)

Home » Financial Education » Volunteer Income Tax Assistance (VITA)

Volunteer Income Tax Assistance (VITA)

The IRS’s Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs offer free basic tax return preparation to qualified individuals.

The VITA program has operated for over 50 years, offering free tax help to help those who need assistance in preparing their own tax returns.

In order to properly process your return quickly effectively, please visit: www.getyourrefund.org/cti

What You Will Need

You will need to up load the following for identity purposes:

- Your Identification (& Spouse if applicable)

- A picture of yourself holding your Identification (& Spouse if applicable)

- A picture of your Social Security Card (& Spouse, & children if applicable and for anyone being claimed as a dependent)

Copy of all Tax Forms that apply to your tax return

- Any W2 Forms

- Any 1099 Forms

- Any 1098 Forms

- Any Misc Forms

- Proof of health insurance: Either Form 1099-HC or 1095-B with a copy of your health insurance card or just your health insurance card

- If you purchased health insurance through the Health Insurance Market Place Online, you will need Form 1095-A

- Any other form you have that applies to your tax return

Other Information

Individuals received free tax preparation last year

Returned to the local economy through tax refunds and credits

Tax returns were filed, with an average of $2634 refund per household

In addition to VITA, the TCE program offers free tax help, particularly for those who are 60 years of age and older, specializing in questions about pensions and retirement-related issues unique to seniors.

While the IRS manages the VITA and TCE programs, the VITA/TCE sites are managed by IRS partners and staffed by their volunteers who want to make a difference in their communities. The IRS-certified volunteers who provide tax counseling are often retired individuals associated with non-profit organizations that receive grants from the IRS.

VITA/TCE services are not only free, they are also a reliable and trusted source for preparing tax returns. All VITA/TCE volunteers who prepare returns must take and pass tax law training that meets or exceeds IRS standards. This training includes maintaining the privacy and confidentiality of all taxpayer information. In addition to requiring volunteers to certify their knowledge of the tax laws, the IRS requires a quality review check for every return prepared at a VITA/TCE site prior to filing. Each filing season, tens of thousands of dedicated VITA/TCE volunteers prepare millions of federal and state returns. They also assist taxpayers with the preparation of thousands of Facilitated Self-Assistance returns

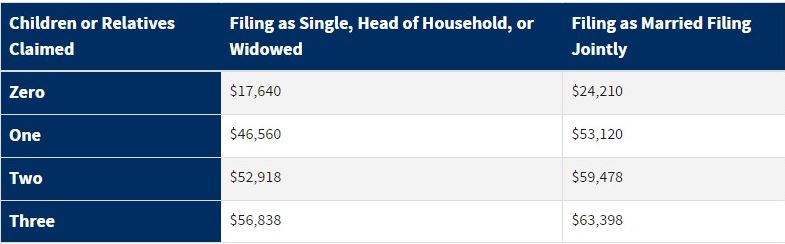

To claim the Earned Income Tax Credit (EITC), you must have what qualifies as earned income and meet certain adjusted gross income (AGI) and credit limits for the current, previous and upcoming tax years.

Use the EITC tables to look up maximum credit amounts by tax year.

If you are unsure if you can claim the EITC, use the EITC Qualification Assistant

Earned Income

Earned income includes all the taxable income and wages you get from working for someone else, yourself or from a business or farm you own.

Types of Earned Income

- Wages, salary or tips where federal income taxes are withheld on Form W-2, box 1

- Income from a job where your employer didn’t withhold tax (such as gig economy work) including:

- Driving a car for booked rides or deliveries

- Running errands or doing tasks

- Selling goods online

- Providing creative or professional services

- Providing other temporary, on-demand or freelance work

- Money made from self-employment, including if you:

- Own or operate a business or farm

- Are a minister or member of a religious order

- Are a statutory employeeand have income

- Benefits from a union strike

- Certain disability benefits you got before you were the minimum retirement age

- Nontaxable Combat Pay (Form W-2, box 12 with code Q)

- If you claim nontaxable combat pay as earned income, it may increase or decrease the amount of your EITC. For more information, see Publication 3, Armed Forces Tax Guide.

Earned income does not include:

- Pay you got for work when you were an inmate in a penal institution

- Interest and dividends

- Pensions or annuities

- Social Security

- Unemployment benefits

- Alimony

- Child support

EITC Tables

Use these table organized by tax year to find the maximum amounts for:

- Adjusted gross income (AGI)

- Investment income you can make

- Credit amount you can claim

2023 EITC Chart

These Topics are about the first Economic Impact Payment.

- Topic A: EIP Eligibility

- Topic B: Requesting My Economic Impact Payment

- Topic C: Calculating My Economic Impact Payment

- Topic D: Receiving My Payment

- Topic E: EIP Cards

- Topic F: Payment Issued but Lost, Stolen, Destroyed or Not Received

- Topic G: Non-Filers Tool

- Topic H: Social Security, Railroad Retirement and Department of Veteran Affairs benefit recipients

- Topic I: Returning the Economic Impact Payment

- Topic J: Reconciling on your 2020 tax return

- Topic K: General Information

What is the Recovery Rebate Credit?

The Recovery Rebate Credit is authorized by the Coronavirus Aid, Relief, and Economic Security (CARES) Act and the COVID-related Tax Relief Act. It is a tax credit against your 2020 income tax. Generally, this credit will increase the amount of your tax refund or decrease the amount of the tax you owe.

The Recovery Rebate Credit was eligible to be paid in two rounds of advance payments during 2020 and early 2021. These advanced payments of the Recovery Rebate Credit are referred to as the first and second Economic Impact Payments.

Individuals who received the full amounts of both Economic Impact Payments do not need to complete any information about the Recovery Rebate Credit on their 2020 tax returns. They already received the full amount of the Recovery Rebate Credit as Economic Impact Payments. You received the full amounts of both Economic Impact Payments if:

- Your first Economic Impact Payment was $1,200 ($2,400 if married filing jointly for 2020) plus $500 for each qualifying childyou had in 2020; and.

- Your second Economic Impact Payment was $600 ($1,200 if married filing jointly for 2020) plus $600 for each qualifying child you had in 2020.

Who can claim the Recovery Rebate Credit?

Eligible individuals who did not receive the full amounts of both Economic Impact Payments may claim the Recovery Rebate Credit on their 2020 Form 1040 or 1040-SR. To determine whether you are an eligible individual or the amount of your Recovery Rebate Credit, complete the Recovery Rebate Credit Worksheet in the Instructions for Form 1040 and Form 1040-SR.

Generally, you are eligible to claim the Recovery Rebate Credit if you were a U.S. citizen or U.S. resident alien in 2020, cannot be claimed as a dependent of another taxpayer for tax year 2020, and have a Social Security number valid for employment that is issued before the due date of your 2020 tax return (including extensions).

You must file Form 1040 or Form 1040-SR to claim the Recovery Rebate Credit even if you are normally not required to file a tax return. Anyone with income of $72,000 or less can file their Federal tax return electronically for free through the IRS Free File Program. Free File is a public-private partnership between the IRS and many filing and tax preparation software providers who provide their brand-name products for free. The safest and fastest way to get a tax refund is to combine electronic filing with Direct Deposit.

Taxpayers residing in American Samoa, Guam, Puerto Rico, the U.S. Virgin Islands, and the Northern Mariana Islands

If you reside in a U.S. territory, do not complete the Recovery Rebate Credit Worksheet and don’t enter an amount on line 30 of Form 1040 or Form 1040-SR. In general, the tax authorities in American Samoa, Guam, Puerto Rico, the U.S. Virgin Islands, and the Northern Mariana Islands will provide the Recovery Rebate Credit to eligible residents. Territory residents should direct questions about Economic Impact Payments or the 2020 Recovery Rebate Credit to the tax authorities in the territories where they reside.

Form 1040 and 1040-SR Instructions – Recovery Rebate Credit Worksheet

If eligible, you can claim the Recovery Rebate Credit when you file your 2020 tax return (Form 1040 or Form 1040-SR) electronically using tax software or on paper. The 2020 tax return instructions include a worksheet you can use to figure the amount of any Recovery Rebate Credit for which you are eligible. The worksheet requires you to know the amounts of your Economic Impact Payments.

Your Recovery Rebate Credit amount will be phased out if your adjusted gross income for 2020 exceeds $150,000 if you are married filing a joint return or filing as a qualifying widow or widower, $112,500 if you are using the head of household filing status, or $75,000 if you are using any other filing status.

How do I find the amounts of my Economic Impact Payments?

IRS letters

You should have received IRS Notice 1444 for the first Economic Impact Payment, and you should receive Notice 1444-B for the second Economic Impact Payment. Refer to them when completing your 2020 tax return. If eligible for the Recovery Rebate Credit, you will use the information from these letters to determine the amounts to include on the Recovery Rebate Credit Worksheet or in your tax preparation software to help you calculate your credit amount.

Get the information you need from your account

Log in to your Federal tax account information online to view what you may need when you electronically file your 2020 tax return (Form 1040 or Form 1040-SR). Two important reasons to have an account now are:

- In the coming weeks, individuals with an account on gov/accountwill be able to view the amounts of the Economic Impact Payments they received.

- Some people will need the amount of their adjusted gross income from 2019 if they use different software to file their tax returns for 2020.

Be sure you have this important information that you’ll need to file your tax return for 2020 by visiting Secure Access now to prepare and set up your own Federal tax account online.

For more information about Economic Impact Payments go to:

Economic Impact Payment Information Center

Questions and Answers about the Second Economic Impact Payment

IRS Statements and Announcements – include statements about Economic Impact Payments

For Clients that do not qualify for VITA

Do your taxes online for free using one of the Free File IRS partner offers.

Are you one of the 70% of Americans eligible to file your taxes for free online using one of the Free File IRS partner offers? If your adjusted gross income (AGI) was $72,000 or less—then, yes, you are. Review each partner’s offer to make sure you qualify for your free federal return. Each partner has its own special offers, including some that offer free state tax returns.

You may use the IRS Free File Online Lookup Tool to narrow the number of partner offers you may qualify for or Browse All Offers to see which are specific to your needs. After selecting one of the Free File offers, you will leave the IRS.gov website

REMINDER: If you are receiving Unemployment Benefits, it may be important for you to choose to have taxes taken out, as you will be receiving a 1099G form in January when you file taxes. Depending on your income bracket, you may have to pay taxes on their benefits.

For more info they can visit https://www.irs.gov/taxtopics/tc418

Topic No. 418 Unemployment Compensation

The tax treatment of unemployment benefits you receive depends on the type of program paying the benefits. Unemployment compensation includes amounts received under the laws of the United States or of a state, such as:

- State unemployment insurance benefits

- Benefits paid to you by a state or the District of Columbia from the Federal Unemployment Trust Fund

- Railroad unemployment compensation benefits

- Disability benefits paid as a substitute for unemployment compensation

- Trade readjustment allowances under the Trade Act of 1974

- Unemployment assistance under the Disaster Relief and Emergency Assistance Act of 1974, and

- Unemployment assistance under the Airline Deregulation Act of 1978 Program

If you received unemployment compensation during the year, you must include it in gross income. To determine if your unemployment is taxable, see Are Payments I Receive for Being Unemployed Taxable?

You may be required to make quarterly estimated tax payments. However, you can choose to have federal income tax withheld. For more information, refer to Form W-4V, Voluntary Withholding Request (PDF). You should receive a Form 1099-G, Certain Government Payments (PDF) showing the amount of unemployment compensation paid to you during the year in Box 1, and any federal income tax withheld in Box 4. Report the amount shown in Box 1 on line 7 of Schedule 1, (Form 1040 or 1040-SR), Additional Income and Adjustments to Income (PDF) and attach this to the Form 1040 (PDF) or Form 1040-SR (PDF). Include the withholding shown in Box 4 on line 17 of Form 1040 or Form 1040-SR. For more information on unemployment, see Unemployment Benefits in Publication 525.

- Name

- Title

- Programs

- Phone

Latest News

More About This Program:

Eligibility Information

Service Area: Merrimack Valley and North Shore

Must qualify for the Earned Income Tax Credit (EITC)

- People who generally make $64,000 or less

- Persons with disabilities; and

- Limited English-speaking taxpayers

Thank you for your interest in having your tax returns prepared at Community Teamwork, Inc. (CTI).